County Sets Tax Rate – Lower Rate, but Will Still Pay More

By Gloria Way

At its regular meeting last Tuesday, September 9th, Chambers County Commissioners Court set a proposed tax rate of $0.439746/$100 and set a public hearing on the proposed tax rate for September 23, 2025, at 10 am in the county courthouse. Even though there is a decrease of 0.06% per $100 from the 2024 rate of $0.440035, residential property owners will be paying an average increase of 17.07%. The 2024 average homestead taxable value was $248,538 while the 2025 average homestead is $290,963. The 2024 tax on average homestead was $1,093.65 and the 2025 tax on average homestead is $1,279.50.

The tax rate has decreased by $.10 between 2020-2024.

The notice of public hearing on tax increase is on page 7.

Commissioners Court also approved the 2026 budget. It was noted that the certified values of the county increased from the 2024 value of $17,746,909,884 to the 2025 value of $20,963,990,445. The different of $3.2 billion accounts for an increase of $18%. New improvements accounted for $3 billion. Certified values have increased by 81%, or $9.3 billion between 2020-2025.

Chambers County employees will receive an across the board raise of 3%. Employee insurance health insurance will increase 3%. The county will hire nine new employees. One employee at the golf course, two for IT, three in Parks and Recreation, one in the Sheriff’s, Health department will hire two new employees.

Commissioners Court also accepted the 2024 Annual Comprehensive Financial Report and Single Audit Report by Pattillo, Brown, and Hill, L.L.P. who gave Chambers County a “clean” report.

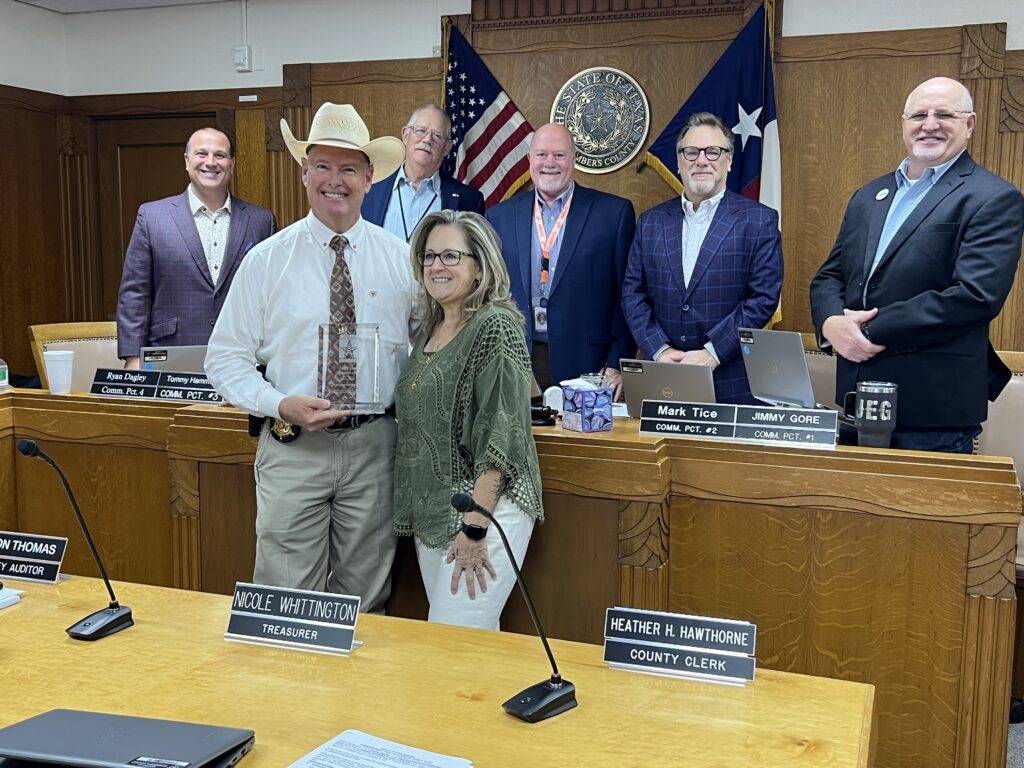

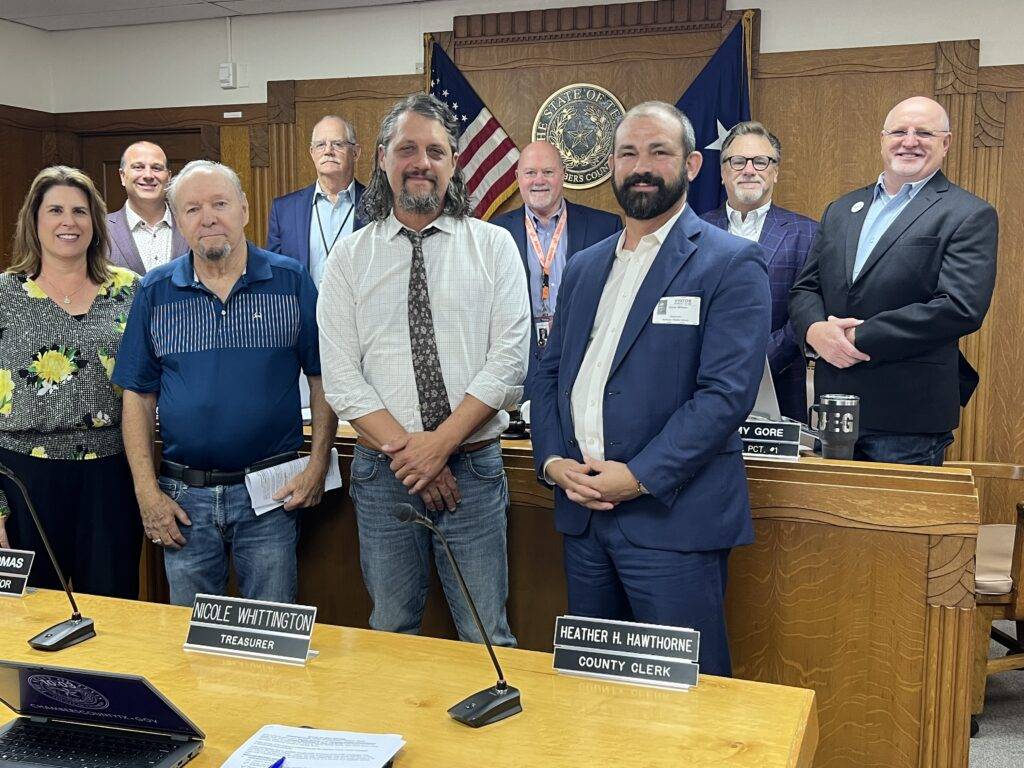

The Texas Rice Festival was honored at Commissioners Court for receiving a State of Texas Official Historical Marker. Front row Commissioner Pct 2 Mark Tice, Chuck Chandler with the Chambers County Historical Commission, Steve and Melissa Hodges – TRF representatives, Commissioner Pct 1 Jimmy Gore, and 2025 TRF President Karen Alton. Back row: Commissioners Pct 4 Ryan Dagley and Pct 3 Tommy Hammond. and County Judge Jimmy Sylvia.